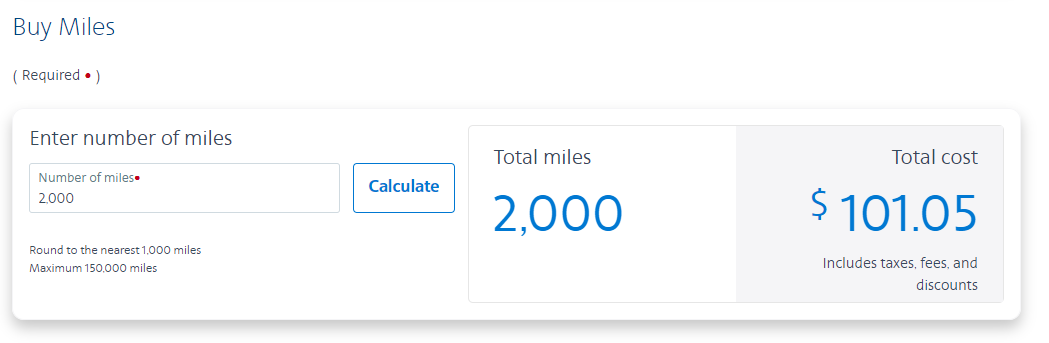

The IHG® Rewards Club Premier Credit Card offers loyal patrons unprecedented earning potential towards the IHG Rewards Club which can be redeemed for complimentary or discounted hotel stay, airline miles, and more. With IHG ® having over 5,000 properties in 100 countries around the globe, their co-branded hotel card from Chase makes it easy to turn every adventure into a luxurious embarkment – wherever your travels may take you. This card features an annual fee of $89 which is not waived during the first year. However, cardholders can immediately recoup the card cost with valuable membership perks, a generous signup bonus and the card’s strong earning potential. The average value per point varies by hotel and the location but, after comparing rates from cities around the United States typically fell between $.003 and $.005 – less than 1¢ each. While there were no clear trends between hotel brands, it appeared that the more popular destinations (South Beach and New York City) had the least valuable redemption rates. To get the most bang out of your IHG rewards program, redeeming points at less coveted destinations will stretch point balances further. Using American Airlines as an example: To purchase 2,000 miles directly on the aa.com site would cost $101.05. Earning 10,000 points using the IHG® Rewards Club Premier credit card would cost: While the exchange may not look bad on paper, the actual discrepancy in value is apparent once you crunch the numbers. As such, this redemption method isn’t highly recommended either. Spend $2,000 within the first 3 months of opening an account and you’ll find yourself with 80,000 bonus points – and with complimentary hotel stay starting at 5,000 points, this signup bonus can go a long way. If your annual spending tops $20,000 per account calendar year, you’ll be well-rewarded with an anniversary bonus of 10,000 points. While $20,000 may seem steep to earn enough points for potentially one night’s stay, those who were likely to spend that much, whether there was incentive or not, will find this perk an easy way to earn extra rewards for the purchases they were already intending to make. On top of an impressive signup bonus, new cardholders can enjoy amplified earning potential on purchases for the first 12 months of opening an account: Earn a whopping 40X points per dollar spent at any IHG hotels or resorts and 4X points per dollar on all other purchases. Cardholders who wouldn’t already spend $20,000 per calendar year should not push their spending to unnatural limits just to reach this. Considering that the average 2-night stay requires between 30,000-70,000 points, aiming to reach such a high threshold wouldn’t result in achieving additional IHG award stay. Overall, the IHG® Rewards Club Premier credit card is an incredibly compelling hotel card. It’s difficult to ignore such a substantial signup bonus and the unmatched earning power of the card within the first 12 months. If you’re not already a loyal IHG Hotels & Resorts patron, this card might make you consider becoming one. Opportunities for a free night stay are available at nearly every turn – even after earning the signup bonus. The IHG® Rewards Club Premier credit card provides value to cardholders long after the introductory period is over, even if only in a limited capacity. The automatic Elite status hosts a bevy of benefits and would still make a strong case to apply for this card, even if that was the only perk offered. Although the card includes bonus rewards for gas, groceries, and restaurants, the low value of each individual point better lends this card to be used solely for booking hotel stays. Other rewards cards will likely provide far more lucrative returns on those popular categories. While it may be tempting to make this your primary credit card because of the annual fee, cardholder can rest assured they’ll get their money’s worth out of the IHG® Rewards Club Premier credit card simply from the free reward night that’s given on every account anniversary. The only shortcomings of this card are that the perks and redemption methods are almost exclusively geared towards hotel-related stays. There are no options for cash back or a statement credit, which makes this card slightly less versatile compared to other cards – but what this card does offer more than makes up for the specificity of the redemption options. If you travel at least once a year to a location where lodging is needed, the IHG® Rewards Club Premier credit card is a strong hotel card that will continue delivering value for years to come. Want the perks with a lower annual fee? Check out the IHG Rewards Club Traveler credit card.Checking-In to the IHG® Rewards Club Premier Credit Card

How it Works

Earning Points:

Redeeming Points:

It’s difficult to accurately valuate each IHG point for this redemption method, as the actual dollar value of the donation is not shown. Instead, selecting a charity “product” will only display a description of what the donation could be used for.

While giving back to the less fortunate is always a worthy cause, our one caveat about this redemption option is that donated points are not counted as tax-deductible donations. Today’s Bonus Offer

Getting Under the Sheets with the IHG® Rewards Club Premier Credit Card

Hotel Perks:

Travel Perks:

Additional Perks:

“Suite” Perks That Make the IHG® Rewards Club Premier Credit Card Worthwhile:

“Reservations” About the IHG® Rewards Club Premier Credit Card:

Time to Check-Out

Editorial Disclosure — The opinions expressed on HotelCards’ reviews, blogs, and all other content on or relating to the website are solely those of the content’s author. They are not reflective of any card issuer or financial institution and have not been reviewed or approved by these entities unless otherwise noted. Further, HotelCards lists credit card offers that are updated daily with information believed to be accurate to the best of our knowledge.